Private 5G growth stymied by pandemic, lack of hardware

Private 5G networks are hailed as a technological marvel, promising low latency, high reliability, and seamless connectivity for a multitude of devices. Despite these promises, experts reveal that the adoption of private 5G networks in the enterprise realm, including the vibrant UAE tech scene, has faced a slower trajectory than anticipated. Factors such as the pandemic and the gradual evolution of the device ecosystem have played a pivotal role in shaping this landscape.

Private 5G Networks: Global Market Dynamics and UAE’s Standpoint

- Current Market Size: In 2021, the global private LTE and 5G wireless infrastructure market yielded $1.8 billion in revenue. This figure is projected to surge to $8.3 billion by 2026, a growth rate that IDC highlights as “slower than expected.”

- UAE’s Technological Ambitions: In the context of UAE’s progressive tech aspirations, the growth and development of private 5G networks align with Dubai’s vision of a smart and interconnected city.

Key Factors Influencing Private 5G Adoption

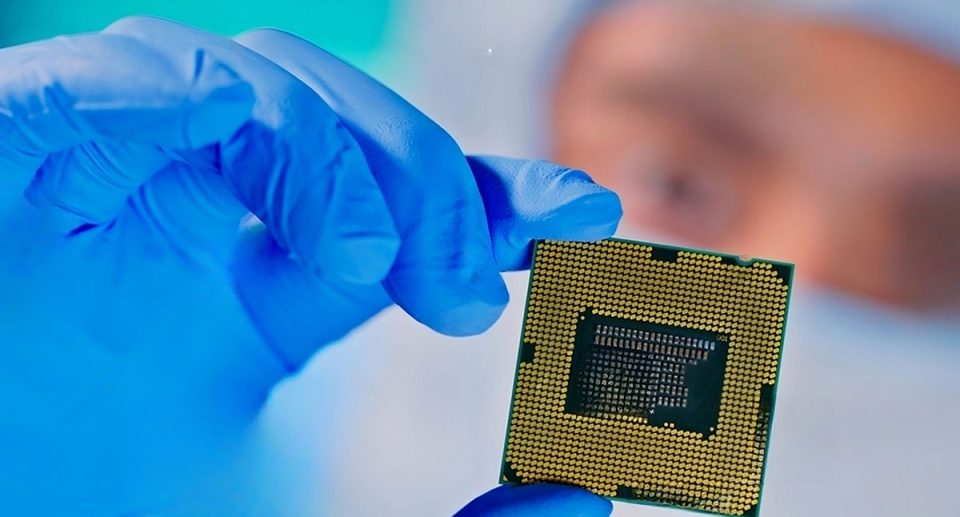

- Protocols and Hardware Development: Private 5G deployment has been hindered by ongoing developments in protocols and hardware, particularly in managing massive machine connections and achieving low latency. The hardware and chip sets required for robust private 5G networks are still in the evolutionary phase.

- Economies of Scale and Pricing: The nascent nature of hardware has prevented the realization of economies of scale, contributing to pricing challenges. Connectivity costs associated with licensed spectrum and the implications of charging for each connected device have also deterred adoption.

- Skills and Talent Gap: A dearth of 5G skill sets and talent has affected deployment. Existing expertise is largely affiliated with telecom operators, and a holistic skill pool for private 5G is yet to be established.

Private vs. Public 5G Networks: UAE’s Prospective

- Public Networks in UAE: Major cellular carriers in UAE, akin to global trends, have initiated public 5G projects, albeit with limited coverage. These networks are leveraged for various applications including supporting remote staff, IoT devices, and edge computing.

- Private Network Options: The UAE’s tech ecosystem can explore private 5G through partnerships with cellular carriers or opt for fully independent private networks. The latter utilizes shared Citizens Broadband Radio Service (CBRS) spectrum or unlicensed spectrum like 5G NR-U.

- Niche Use Cases: Industries such as manufacturing, warehousing, logistics, mining, utilities, and large venues are current frontrunners in adopting private 5G. UAE’s diverse economy can find resonance in these use cases.

Future Perspectives and Challenges in UAE’s Private 5G Landscape

- The Need for Use Cases: UAE enterprises venturing into private 5G networks should focus on well-defined use cases that genuinely leverage the technology’s capabilities.

- Scale and Interoperability: Scaling from small setups to larger deployments and ensuring interoperability between multiple devices and vendors are essential challenges.

- Market Expansion and Edge Computing: As the market matures, UAE’s private 5G adoption is expected to encompass retail, healthcare, and large campuses. Edge computing integration, especially relevant for applications like telemedicine, stands out as a crucial feature.

UAE’s Pioneering Initiatives and Companies

- Telemedicine and AR/VR: UAE can emulate global initiatives like telemedicine powered by 5G. Augmented and virtual reality applications for training and diagnostics, along with enhanced edge computing capabilities, can revolutionize sectors like healthcare.

- Agriculture Automation: UAE’s innovative spirit can manifest in sectors like agriculture, where startups are harnessing 5G to automate tractors and fleet management. The nation’s rural landscapes can benefit from reliable, low-latency connectivity.

Choosing the Path Forward: Collaborations and Self-Building

- Collaborations and Expertise: Enterprises in UAE may collaborate with cellular carriers, networking suppliers, or cloud providers to facilitate private 5G deployments. UAE’s tech entities should tap into the expertise of telecom giants, networking leaders, and cloud service providers.

- Emerging Companies and DIY Approach: Exploring emerging 5G-focused companies like Celona, Inseego, Cradlepoint, and EZELINK can provide innovative solutions. The option of building private 5G networks in-house should be considered for organizations with substantial in-house expertise.

Conclusion: UAE’s Journey into Private 5G Networks

The journey toward private 5G networks in UAE is marked by challenges and opportunities. As the technology matures, the UAE tech landscape must define use cases, address scalability, ensure interoperability, and seize the potential of edge computing. With the right strategies, collaborations, and innovative initiatives, UAE has the potential to emerge as a frontrunner in the private 5G domain, aligning with its ambitions for technological advancement and digital transformation.